Other FreightWaves Products

Tony Mulvey

Rejection rates holding above 5% ahead of ‘peak season’

Tender volumes declined over the week, but tender rejections and spot rates found a little positive momentum over the past week.

Impacts from Hurricane Milton waning

Tender volumes and rejection rates moved lower over the past week, while spot rates increased slightly during the week.

Hurricane Milton helps boost rejection rates

Tender volumes and rejection rates moved higher over the past week, but spot rates were unaffected on a national level.

Hurricane Milton already impacting Florida freight markets

Inbound loads to Lakeland are being rejected at elevated rates.

A slight rebound to start the fourth quarter

Spot rates and tender rejection rates saw a slight increase to start Q4, but tender volumes fell as a result of the ILA strike.

Market closing September on a sour note

Tender volumes, tender rejection rates and spot rate all drop in the final full week of the third quarter.

Steady as can be

Tender volumes have started to flatten out while tender rejection rates have picked up a little steam this week.

Hurricane Francine does nothing to help freight market

Tender volumes have continued to show strength, but the market remains oversupplied. Hurricane Francine had little impact on the market

Labor Day sadness

Tender rejection rates suffered the largest weekly decline in the past 6 weeks while tender volumes are being impacted by the holiday weekend

Market rises into Labor Day but falls well short of Fourth of July

Tender volumes closed August higher, up 3.13% year over year. A slight rise in rejection rates before Labor Day was still below July peaks.

Labor Day impacts yet to arrive

Tender volumes increased over the past week, while tender rejection rates remained unchanged. The next week will be important for the direction of the freight market in the fourth quarter.

Stability reigns supreme in August

Tender volumes started to gain a little positive momentum over the past week while tender rejection rates inched slightly lower…

Stable start to August

The freight market is fairly stable to start August as spot rates and tender rejection rates experienced little change week over week…

Putting a bow on July

Spot rates moved slightly higher in the final week of July, while rejection rates and volume levels continued to retreat from recent highs.

Late July cool-off

Spot rates have retreated off their recent high, but remain elevated compared to the rest of the year while demand and rejection rates are following seasonal trends.

Shaking off the summer doldrums

The freight market is appearing to stabilize at higher levels after the Fourth of July, setting up for a better second half of 2024.

Post-Fourth of July blues

The freight market was more reactive to the Fourth of July holiday than the year prior, but capacity has been quick to return to the road.

Feels like summer

Volumes, rejection rates and spot rates remain elevated, setting the stage for the summer months.

Post-holiday bump setting the stage for summer

Volumes, rejection rates and spot rates remain elevated following the Memorial Day holiday, setting the stage for the summer months.

Port roundup: Strong annual growth across the board

Despite the timing of the Lunar New Year, import volumes at three of the largest U.S. ports rose year over year.

Descartes: Container import volume trajectory is strong

The East and Gulf Coast ports continue to take market share from the largest West Coast ports, which had a challenging March.

Port Houston shows import strength in February

Port Houston reported strong imports after a soft January as general cargo tonnage represented nearly 40% of total import tonnage in the month.

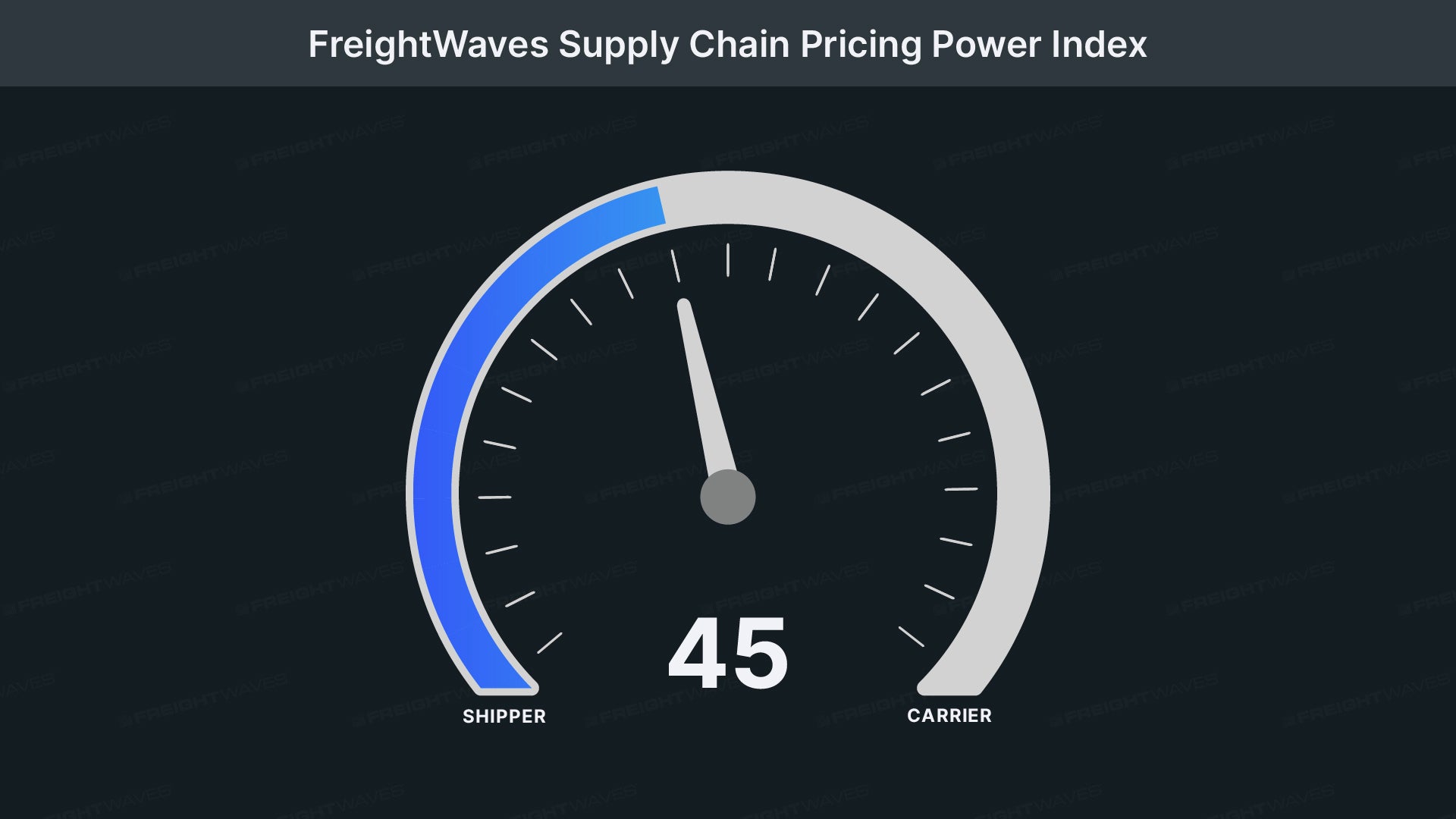

Carriers’ pricing power slipping amid continued Red Sea conflict

The initial shock factor is waning and ocean spot rates are losing momentum across the globe.

Restocking boosts January US port activity

The CEO of the Port of Long Beach boss cited restocking ahead of the Lunar New Year as the driver for import growth in January.

Are ocean spot rates past their peak?

Spot-exposed carriers are likely to see a boost to their Q1 2024 financials.

Port of Los Angeles shines in January

Port director Gene Seroka cited replenishing inventory and consumer spending as drivers of growth.

Water level projections threaten future Panama Canal transits

Hopes for a significant rebound in Panama Canal water levels to boost throughput will likely be met with a harsh reality over the next few months.

10 days’ notice

Freight volumes continue to trend sideways, which is a positive sign overall as the 15th of July traditionally marks a time for slowing demand in the freight market.

C.H. Robinson stock sinks on revenue, earnings miss

Forwarding income from operations was nearly cut in half and truckload prices to customers fell by double digits year over year.

Hurricane Ian brings positive rate pressure, but for how long?

Hurricane Ian boosted spot rates in the southeast over the past 10 days, but as rejection rates and volumes decline, when will spot rates on a national level take another step lower.

A stable week paves the way for lower rates

Contract and spot rates continue their downward trend despite volume levels and rejection rates flattening out…

C.H. Robinson surpasses profitability expectations

Robinson’s NAST revenue rises despite LTL volume declines and modest TL growth.

C.H. Robinson supera las expectativas de rentabilidad

El beneficio por acción del 3PL aumentó un 85,4% interanual hasta los 2,67 dólares

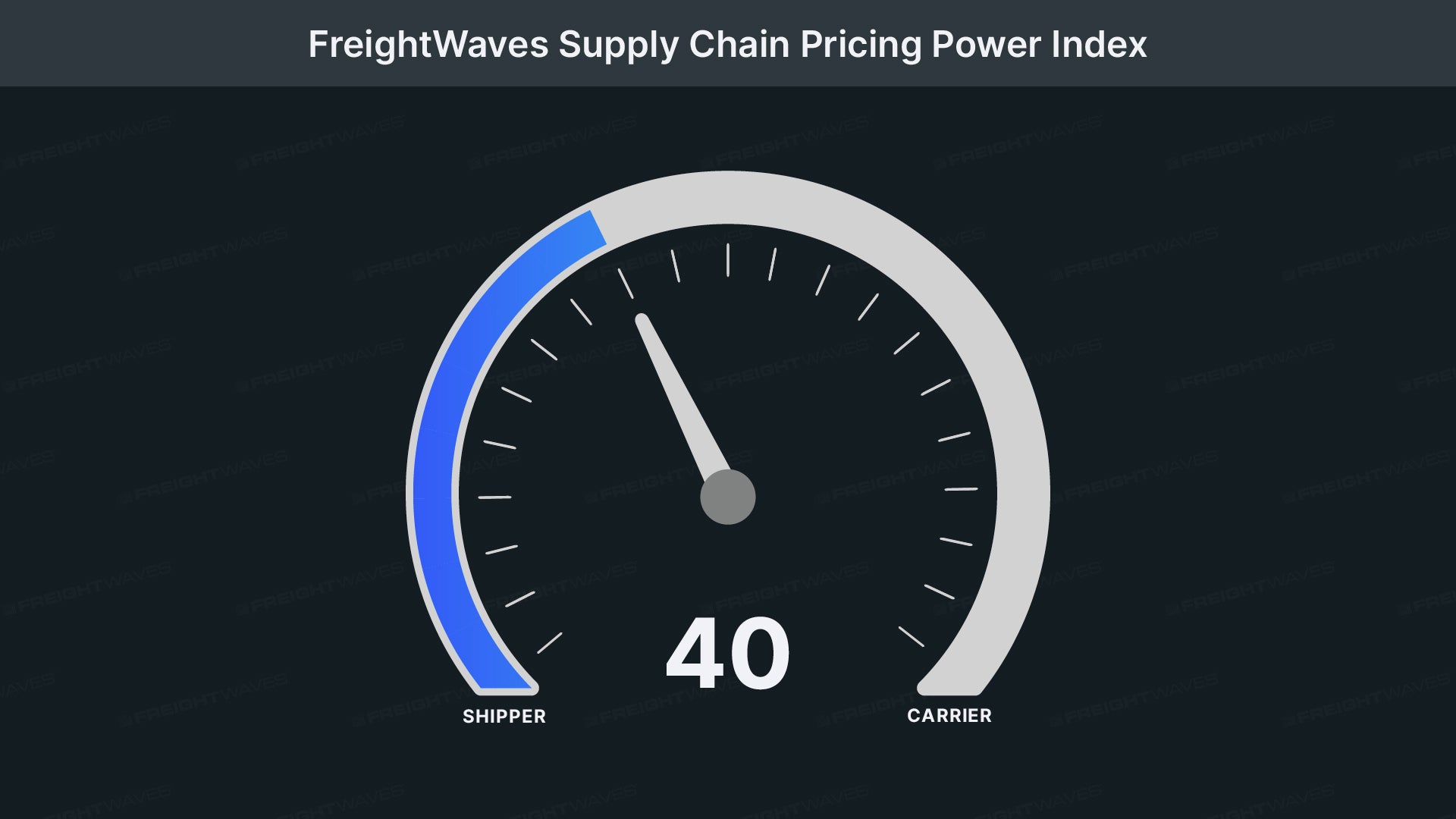

Shippers take pricing power as softening conditions continue

Spot rates continue the rapid descent as truckload capacity continues to loosen rapidly. At the same time, accepted tender volumes turn…

Rejection rates continue rapid descent, pulling rates down with them

Tender rejection rates are rapidly headed toward single digits, causing spot rates to resemble a black diamond slope rather than the bunny…

Falling rejection rates prop up a truckload market with middling freight demand

Both tender volumes and tender rejection rates take a breather over the past week. It’s too early to be called a trend but definitely…

Freight volume remains strong in run-up to produce season

Tender volumes recover most of last week’s decline while rejection rates continue their slow downward trend despite contract rate increases…

Tender volumes slump as current contract rates find solid footing

Tender volumes take a February nap, sliding 4% over the past week while rejection rates were flat despite weather affecting certain markets..

Spot rates and rejection rates slide but carriers reluctant to give up pricing power

Tender volumes continue to outperform year-ago levels. Rejection rates have declined throughout the past week as carriers return to major…

Carriers headed to the large markets but reluctant to give up pricing power

Tender volumes continue to outperform year-ago levels. Rejection rates have declined throughout the past week as carriers return to major…

Carriers reject 1-in-5 loads, signaling who has the upper hand in pricing

Tender volumes continue to outperform year-ago levels. Rejection rates have declined throughout the past week as carriers return to major…

Carriers remain in the driver’s seat when naming rates

Tender volumes continue to outperform year-ago levels. Rejection rates have declined throughout the past week as carriers return to major…

Carriers hesitant to give any pricing power back to shippers

Tender volumes continue to outperform year-ago levels. Rejection rates are continuing to rise in a unseasonable pattern placing pressure…

Record high rates keep pricing power in carriers’ hands

Rates reach new highs as capacity was slow to return to the road following the holidays. Tender volumes are soaring as demand is unrelenting…

Carriers start 2022 with pricing power firmly in their grasps

Truckload volumes are beginning to erase holiday noise associated with Christmas and New Year’s. Rejection rates are staying elevated…

Where did all the truckload capacity go?

After a year of record revenue, carriers are staying of the road during the holiday weeks, holding rejection rates higher for longer…

Holidays place pricing power firmly in carriers’ hands

Rejection rates are now back above 22%, the highest level since early September. Pricing power moved further to carriers despite the holiday related tender volume collapse.

Carriers claw back pricing power as rejections move higher

Rejection rates have surged past the 21% level on the national level. Meanwhile, volumes have turned positive year-over-year. The combination of tightening capacity and stronger demand is placing upward pressure on rates.

Carriers maintain pricing power as rejection rates rise for the holidays

Volumes turn downward heading into the Christmas week while rejection rates have rebound back above 20%. Carriers still maintain a firm grip on pricing power in the market.

Carriers not giving up pricing power during the holiday season

Volume levels are following a similar trend to 2019, just 40% higher. Tender rejection rates are trending sideways, likely to move higher over the next week.

Rates trending higher on dense lanes signal carrier maintain pricing power

Tender volumes decline but remain elevated compared to ‘normal years’ meanwhile rejection rates have found footing around 20%.

Carriers hold on to power as rates increase again

Tender volumes decline but remain elevated compared to ‘normal years’ meanwhile rejection rates have found footing around 20%.

Thanksgiving noise gone, difficult capacity conditions continue

Tender volumes have started to erase the Thanksgiving noise. At the same time, rejection rates have plateaued around the 20% mark.

Thanksgiving drives spot rates higher

Thanksgiving noise continues to mask freight volumes, but that noise will be erased in the upcoming days. Meanwhile, Thanksgiving drove spot rates higher over the past week.

Thanksgiving noise masks where freight market stands

Thanksgiving always leads to a sharp decline in tender volumes. Leading into Thanksgiving freight markets experienced an uptick in accepted volumes.

Thanksgiving week means tighter capacity and higher volume levels

Spot rates didn’t experience the uptick that rejection rates did last week. Thanksgiving is impacting both freight volumes and capacity.

Holiday impacts starting to hit truckload market

Rejection rates have accelerated over the past week as drivers start to come off the road for the holiday.

Capacity tightening ahead of Thanksgiving week

Volume growth dissipates to kick off November while rejection rates remain well below year-ago levels.

Shippers should be hesitant to push down rates just yet

Volume growth dissipates to kick off November while rejection rates remain well below year-ago levels.

Sluggish November start, but shippers haven’t taken back pricing power

Volume growth dissipates to kick off November while rejection rates remain well below year-ago levels. Tightness in Southern California will put upward pressure on rates.

November starts slow, but elevated levels keep pricing power with carriers

Volume growth dissipates to kick off November while rejection rates remain well below year-ago levels. Tightness in Southern California will put upward pressure on rates.

Freight markets find stability during final week of October

Tender volumes rebound as tender rejection rates jump back over 20%. Meanwhile, spot rates break the three-week downward decline.

Conditions have improved, still remarkably difficult heading into peak season

Load volumes are stable with volume growth inbound. Spot rates follow rejection rates on a downward slide.

C.H. Robinson smashes estimates, takes advantage of constrained environment

Biesterfeld expects the capacity-constrained environment to continue.

Shippers claw back some pricing power but rates are still elevated

Load volumes are stable with volume growth inbound. Spot rates follow rejection rates on a downward slide.

Large markets gaining steam ahead of peak season

Freight volumes in the largest markets are starting to accelarting, signaling the start of the peak truckload season.

Southern California strength places pricing power with carriers

Freight volumes in Southern California are starting to ramp, signaling the start of the peak truckload season.

Carriers firmly grasp pricing power as volume levels slide

Elevated accepted tender volumes and rates signal that carriers are maintaining pricing power. Truckload capacity constraints are easing as contract rates climb.

Carriers hold pricing power after sluggish start to Q4

Strong freight volumes signal that carriers are firmly in the driver seat with regards to pricing power.

Carriers grip pricing power firmly as Q3 comes to a close

Strong freight volumes signal that carriers are firmly in the driver seat with regards to pricing power.

Pricing power firmly in carriers’ hands as rates snap back

Spot rate snap back signals that carriers are firmly in the driver seat with regards to pricing power.

Erasing Labor Day noise as load volumes set new all-time high

In this sensitive market, small changes to the balance have deep, long lasting impacts.

Echo smashes estimates, reporting record revenue and volume

In third-quarter 2020 financial and operational results released after trading ended on Wednesday afternoon, Chicago-based third-party logistics provider Echo Global Logistics (NASDAQ: ECHO) reported record gross revenues, which grew by […]

Echo beats on both revenue and earnings

In second-quarter 2020 financial and operational results released after trading ended on Wednesday afternoon, Chicago-based third-party logistics provider Echo Global Logistics (NASDAQ: ECHO) reported gross revenues fell by 7.1% on […]